Our philosophy and approach

We believe in the power of dividend growth

The ThomasPartners Strategies investment philosophy embraces the concept that a meaningful and increasing portfolio dividend income stream can provide investors a predictable source of income with the potential for income growth, without sacrificing the portfolio's total return potential over time.

Our approach starts with three objectives

Feeling confident that you’ll have enough income throughout your retirement. That’s really the core of what ThomasPartners Strategies is all about. And that’s why our approach focuses on monthly income, income growth, and competitive total returns over time.

ThomasPartners’ Strategies have three objectives

-

Create a reliable income source

Seek to provide monthly income by investing in companies with predictable dividends (all strategies) and interest-paying fixed income investments (strategies that include fixed income).

-

Help offset inflation

Strategically invest in dividend-growth companies (all strategies) and fixed income opportunities (strategies that include fixed income) and allocate across sectors in an effort to grow the portfolio’s income over time.

-

Prepare for the future

Seek to deliver competitive total returns over time through income generation and price appreciation.

How we construct portfolios

An extensive bottom-up, fundamental research process is used to evaluate every candidate for the portfolio, and then the selections are strategically combined into a portfolio with an equal emphasis on seeking our three objectives: monthly income, income growth, and competitive total returns.

It’s all about asset allocation

The construction process for our strategies is overseen by the Portfolio Management Team, under the leadership of the Chief Investment Officer of Active Equity Strategies.

Equities

The equity allocation component consists of approximately 50 equities—all dividend payers with the ability to—and that we expect to—grow their dividends. Most are large-cap U.S.-based common stocks, with lesser allocations to mid- and small-cap common stocks, international common stocks (headquartered outside the U.S. that trade in the form of American Depositary Receipts [ADRs] and Ordinary Shares [ORDs]), and domestic MLPs or REITs. ETFs may also be used for indirect MLP exposure.

Generally, stocks with a market capitalization above $1B are selected for client accounts pursuant to a four-step process.

Fixed income

Our fixed income investments provide an additional source of income that complements the dividend-paying companies' equity allocation and adds potential diversification benefits. The fixed income investment allocation utilizes high-quality asset classes to manage both interest rate risk and credit risk.

The fixed income allocation is actively managed, with aggregate duration exposure ranging from around 3.5 years to around 6.5 years and aggregate credit quality typically ranging from A- to AAA, with positioning dependent on Schwab Asset Management's economic outlook and fixed income asset price levels.

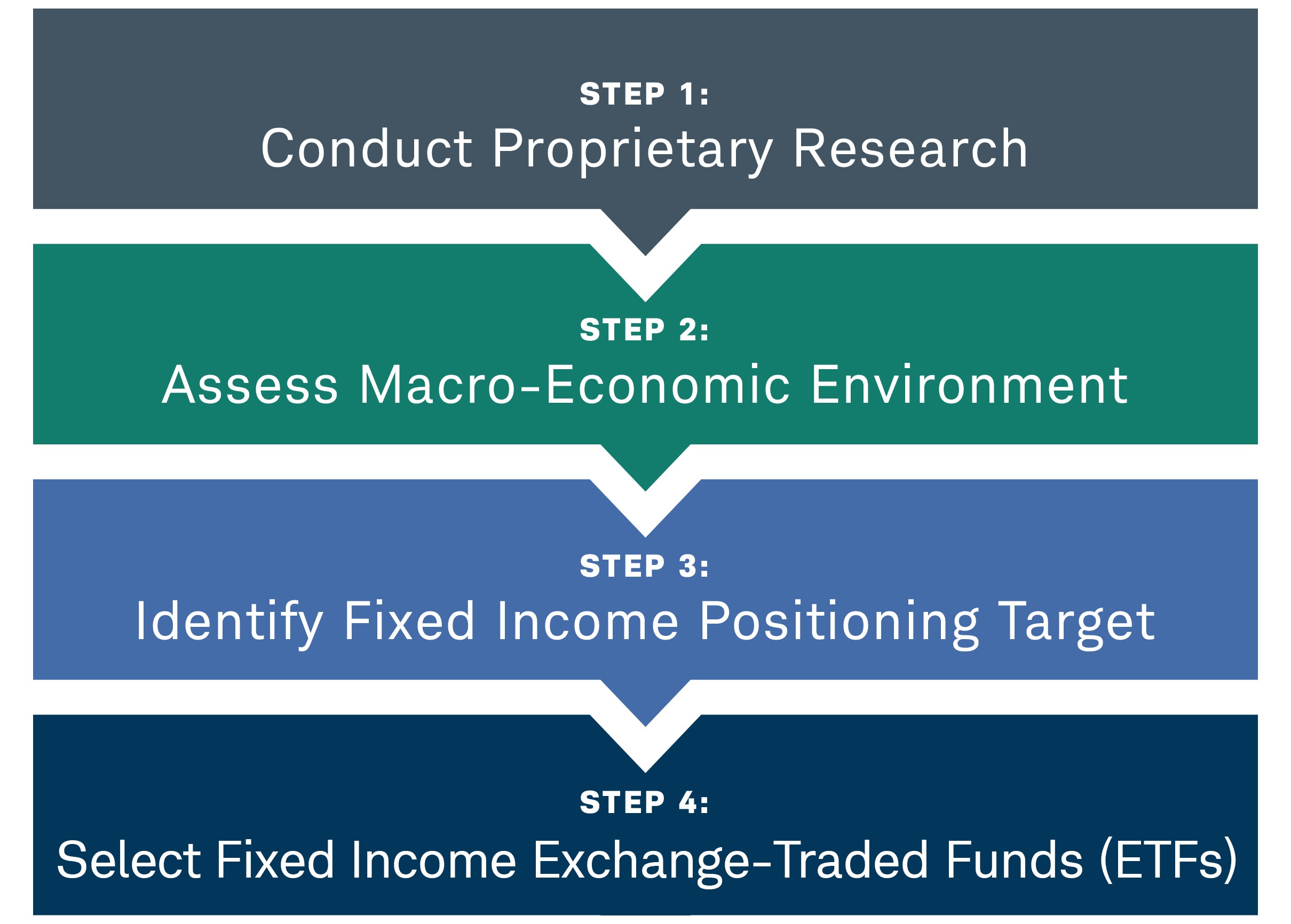

Fixed income investments are selected based on a four-step process.